Payments

Your AppLovin dashboard reflects the total activity and earnings across the AppLovin network and other advertising partners (such as ad networks) that you mediate with MAX.

AppLovin pays you directly for revenue generated from AppLovin Bidding (AppDiscovery) and AppLovin Exchange (ALX). Your advertising partners pay you for revenue generated through those channels.

Read this page carefully to understand AppLovin’s payment process. If you have questions, contact AppLovin Support.

How to Set Up Payment Information

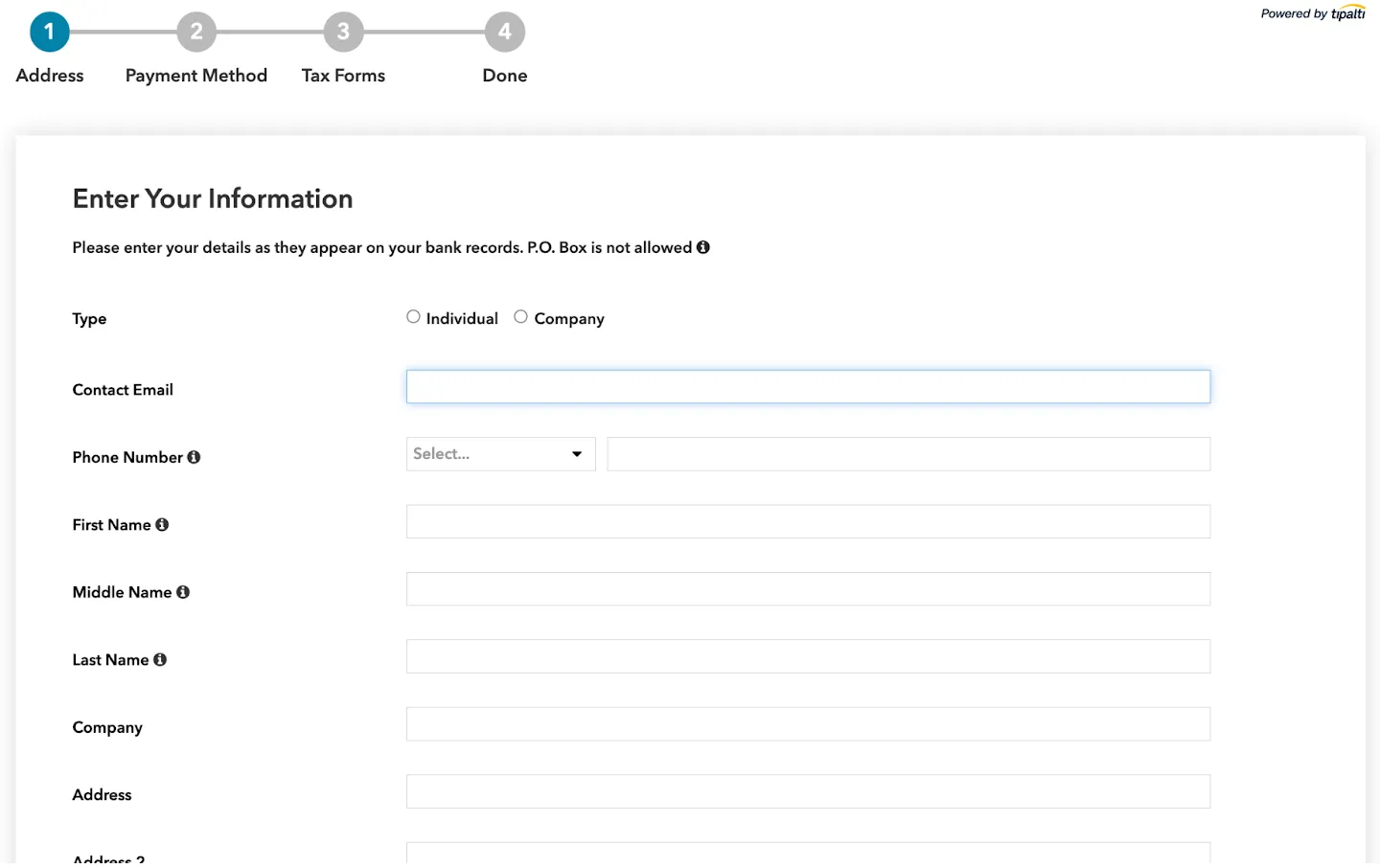

To receive payment for revenue generated through AppLovin, you must first navigate to the payment registration section of your AppLovin dashboard (Account > Payments > Info) and provide all required information until you reach Step #4—“Done”. To receive payments, all information that you provide must be accurate. It also may be subject to additional validation from the AppLovin payments team. Inaccurate or incomplete information may delay your receipt of payments from AppLovin.

Contact your advertising partners directly for questions about payment of revenue generated outside of the AppLovin network and ALX.

Payment Methods

AppLovin offers several payment methods:

- Direct Deposit/ACH

- Wire Transfer

- Check

- PayPal

Some options may not be available to you due to local regulations. Fees and minimum thresholds may apply to some options. For all options, there is a $100 minimum threshold for earnings generated through the AppLovin network before AppLovin issues payments.

Review the Payment Method options under Account > Payments > Info on Step 2 (“Payment Method”), and select the one most suitable for you. You may update this information at any time.

You can also instruct AppLovin to hold your payments (set Payment Method to Hold My Payments). When you select this option, your payments are not released to you but are held in your AppLovin account. When you later select a different, valid payment method, your held payments are released to you in the next payment cycle.

Payment Schedule and Minimum Thresholds

AppLovin pays you monthly if you reach the $100 minimum threshold for accumulated earnings.

AppLovin makes payments on or around the 15th of the following month (NET 15). Please allow up to several business days for funds to post in your account. The actual time when you receive payment is largely dependent on the payment method and on which receiving bank you select. Below are two examples of when you could receive payment:

Example One

In January you earn $150 through the AppLovin network. Some time in early February you see an invoice for “Jan” for $150 under Account > Payments > History. AppLovin submits payment to you on February 15th.

Example Two

In January you earn $35 through the AppLovin network. No invoice is generated (under Account > Payments > History) because this amount is below the $100 minimum earning threshold. In February you earn an additional $75 through the AppLovin network. Around the beginning of March you see an invoice for “Feb” for $110 which also includes your previous earnings from January. AppLovin submits payment to you on March 15th.

Estimating Your AppLovin Payment

To estimate your monthly AppLovin payment, take the following steps:

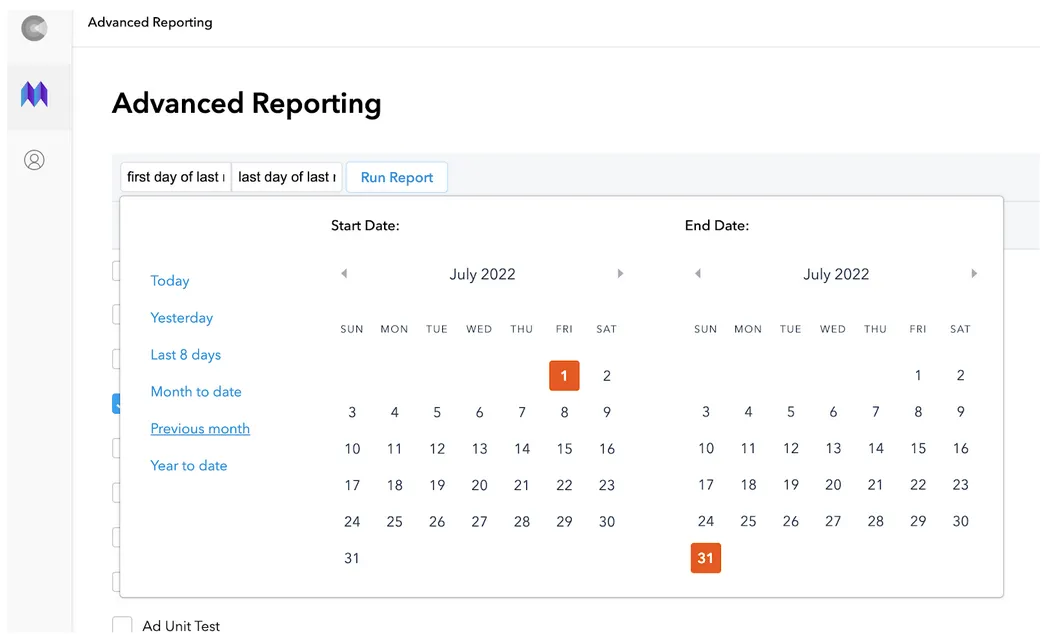

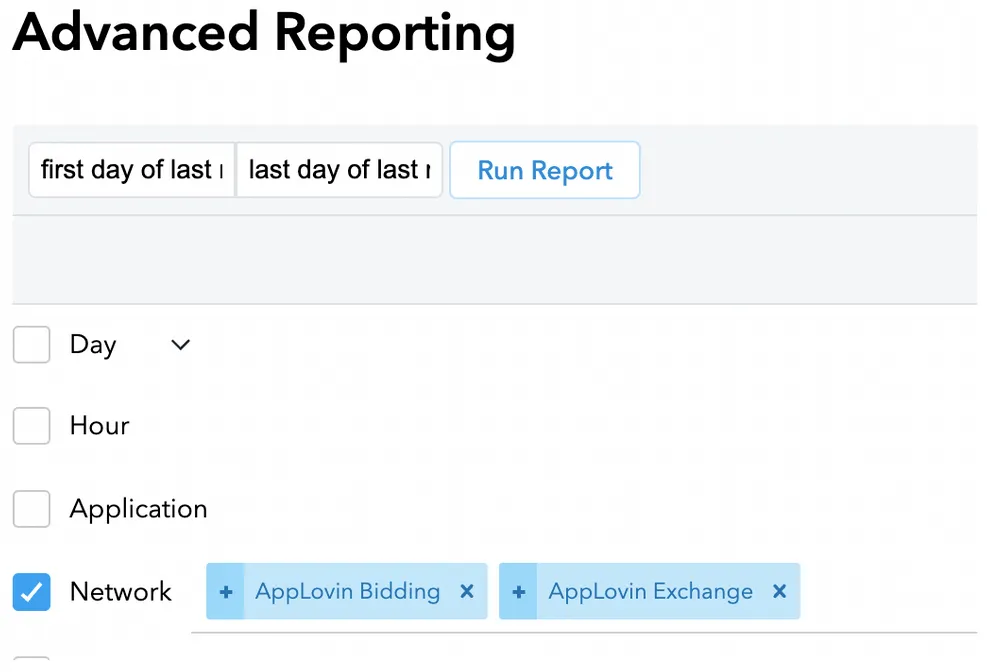

- Navigate to Advanced Reporting (MAX > Analyze > Advanced Reporting).

- Update the reporting timeframe to Previous month.

- Check Network.

Add AppLovin Bidding and AppLovin Exchange to the network filter.

- Click Run Report.

Payment Invoices and History

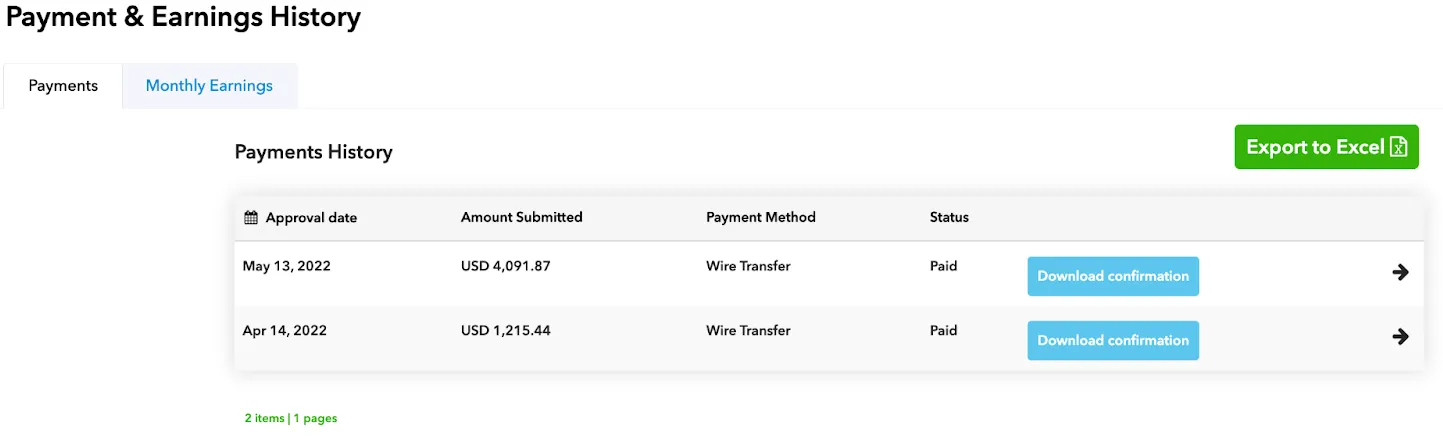

To see which payments have been made or are in progress, open Account > Payments > History. From this page, you can view detailed payment information and you can download payment confirmations as a PDF file.

Frequently Asked Questions

- Whom can I contact with questions about how to complete payment registration?

- Tipalti has several FAQs to help you complete payment registration. If those FAQs and the FAQs here do not answer your question, contact AppLovin Support for assistance.

- Who is Tipalti?

- AppLovin uses the partner payment provider Tipalti. Tipalti provides a variety of payment options for AppLovin’s publishers, and automatic, real-time notifications of payment statuses. This ensures AppLovin continues to provide the best possible experience to its partners.

- How do I access the portal to complete the registration information?

- You can register with Tipalti via the AppLovin dashboard. Log in with your Publisher account and select Account > Payments > Info in the navigation menu on the left of the dashboard. Then complete your payee registration information and payment details. The process should take less than ten minutes.

- Why am I receiving multiple requests to update details?

- Some publishers receive multiple emails from AppLovin if they have more than one account with AppLovin and AppLovin pays each account separately. Fill out the required information for each account separately to ensure payment for each account.

- Do I need to complete the entire registration process in one visit?

- There are three sections you need to complete for payment registration. For each section, after you click Next, the information is saved, so you can complete each section at different times. For the Address section, there is address validation, so after you click Next, you may need to scroll up to the top of the screen to accept the address before you can continue.

- What do I do if my currency is not available?

- The default currency is the local currency of the payment country. You can choose from different payment methods which allow you to select a currency that matches your preferred currency. Fees may apply for non-USD currencies.

- What should I do if my Beneficiary Bank Name for payment does not match my Company Name?

- Tipalti only permits payments to be made to either the individual “Name” or “Company” name identified in the AppLovin Dashboard. If you have a beneficiary name on your bank account that differs from your company name, contact AppLovin Support to explain your situation. AppLovin will review your request, and if it is approved, will permit you to input a Beneficiary Bank Account Name that differs from the Company Name.

- What should I do if my bank account is in another country than my company address?

- During step 1 of the registration process, under Address, select a different Payment Country.

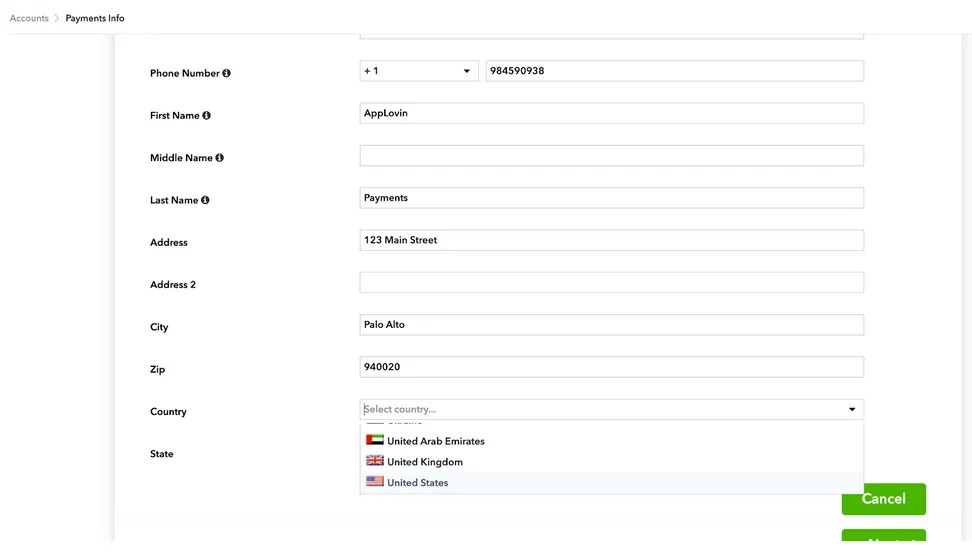

The following screenshot demonstrates this:

If the Country selector is not available, contact AppLovin Support to activate it on your account.

If the Country selector is not available, contact AppLovin Support to activate it on your account.

- Why do I have to complete tax forms in order to receive payment?

- The U.S. Internal Revenue Service requires AppLovin to obtain these tax forms. Although AppLovin may have received them in the past or even very recently, AppLovin needs to obtain them again. AppLovin cannot remit payments without a completed tax form. AppLovin cannot make any exceptions to this requirement.

- Which tax form should I complete?

- A wizard helps you determine which tax form to complete. U.S.-based publishers should complete a W-9 form. Publishers based outside of the U.S. should complete a W-8 form.

- How do I complete a W-8 form?

- To complete a W-8 form, follow the instructions on a series of screens:

- Part 1 (Identification of Beneficial Owner)—Complete name and address information.

- Part 1 (Identification of Beneficial Owner, continued)—Input your Foreign Tax Number provided by your country. You are not expected to have a U.S. Tax Number.

- Part 2 (Claim of Treaty Benefits)—Complete the questions. If it is appropriate for you to certify 0% withholding, also select claim special rates and conditions.

- Review—Review the information for accuracy and completeness.

- Part 3 (Certification)—Check all the boxes to confirm. Note that Line 1=Name of Organization.

- What should I do if I am not permitted to complete a tax form electronically?

- It is best for you to complete the tax form electronically, to ensure accuracy and timely payment. If you cannot do so, instead send your completed tax form via AppLovin Support. AppLovin will review it and update your account. You can download the forms here:

- How can I update my address or bank information after I complete the registration?

- Log into your AppLovin dashboard and update that information. For some address changes, this may invalidate your bank and tax forms. If so, you are alerted in advance. If this does invalidate that information, you can simply update your information again.

- How do I put a hold on my payments?

- You can put a hold on your payments by updating your payment method under Account > Payments > Info in step 2. Set Payment Method to Hold My Payments. This takes effect immediately. It stops you from receiving any payments until you update your payment information. When you are ready to receive payments again, update your payment method on the same page. AppLovin will reschedule payments beginning with its next payment cycle.

- Why did I receive a payment in my bank account that is less than what is displayed on my Payments and Earnings History?

- Contact your bank. The difference might be due to bank fees charged to you by your selected intermediary and/or beneficiary bank, or to FX fees that may apply if you receive any payments in a non-USD currency. For USD payments, AppLovin does not deduct any bank fees from your payments nor does AppLovin’s bank pass on any of AppLovin’s bank fees to you. However, depending on your payment details and circumstances of those banking relationships, the intermediary and/or beneficiary bank may charge you certain fees. AppLovin has no control over those fees and is not responsible for this cost. Work with your bank to determine if there is a desirable intermediary bank that can reduce or eliminate any fees charged to you.

- I’ve reached the $100 earning threshold but I don’t see my earnings in Payments and Earnings History.

- AppLovin posts earnings monthly. If you reach the minimum earnings threshold, you see your earnings under Account > Payments > History several business days after the end of the month.

- Why are the earnings in Payments and Earnings History different from what appears on MAX and/or AppDiscovery reporting, or are missing completely?

- Although your AppLovin dashboard reflects the total activity and earnings across the AppLovin network and advertising partners, AppLovin only pays you directly for revenue generated from AppLovin Bidding (AppDiscovery) and AppLovin Exchange (ALX).

Therefore, the amounts shown in Account > Payments > History on the Monthly Earnings tab only include revenue generated from impressions from within AppLovin’s network.

This amount may differ from the reporting shown on your AppLovin dashboard under these conditions:

- Use of MAX—if you integrated MAX into your applications, note that MAX provides access to numerous networks, and MAX reporting will display total activity for each network. However, the various networks that you linked to your MAX account pay you directly for the impressions filled through those networks. AppLovin pays you directly only for revenue generated from AppLovin Bidding (AppDiscovery) and AppLovin Exchange (ALX). If you have questions regarding payouts from other networks, contact those networks directly.

- Use of Google bidding and Google AdMob mediation—if you mediate your apps through Google bidding and Google AdMob, your AppLovin dashboard shows the total activity across both mediation platforms. Google has two different payment flows for Open Bidding and non-bidding mediation: Google pays publishers directly for Open Bidding traffic, while ad networks (like AppLovin) pay publishers directly for non-bidding mediation traffic. You can learn more about Google Open Bidding payments at the Google Ad Manager Help site. If you have questions regarding payments for Open Bidding, contact Google.

- It’s past the 15th of the month and my earnings are still “in-process” status. Why?

- If your payment profile is missing information, you will receive an email notification to tell you what is missing so you can correct this.

After you add the missing information, AppLovin submits payment.

If you did not receive such a notification, your payment might be deferred for several other reasons:

- If your certificate of no U.S. activities expired, then you need to submit a new one under Account > Payments > Info in Step 3.

- You are under the minimum payment threshold. You can review this under Account > Payments > Info in Step 2. Note that the minimum threshold for wire transfer is $150.

- My payment is frequently rejected. Why?

- AppLovin’s system notifies you if payment was unsuccessful and was returned. You can review the rejection notes under Account > Payments > History by selecting the relevant payment. What you see is the information that is provided to AppLovin by the bank. Verify that all information in Account > Payments > Info is correct. Verify that you identified the correct account for the currency option you selected. If you are unsure, contact your bank to validate the information. When you update your information, AppLovin automatically reattempts payment with its next scheduled payment cycle.